Quantitative Signal Consistency Ledger for 3458351150, 108497, 912907929, 1438989233, 18663486231, 120234273

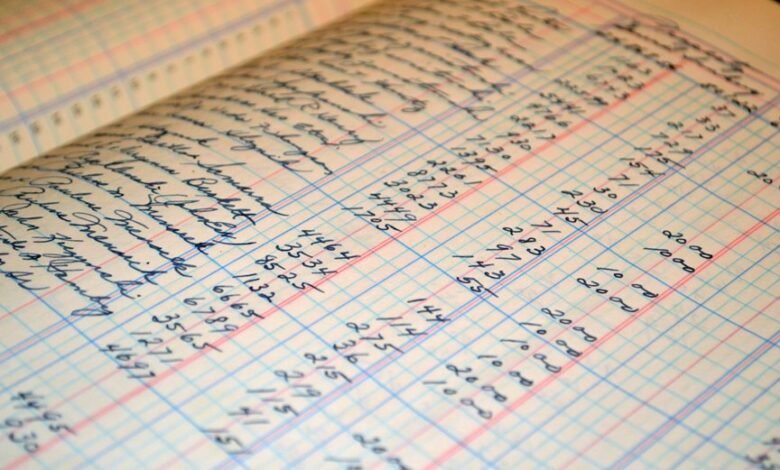

The Quantitative Signal Consistency Ledger (QSCL) serves as a critical tool for evaluating the integrity of financial metrics related to identifiers such as 3458351150 and 108497. By systematically analyzing discrepancies, the QSCL enhances transparency and reliability within data sets. This framework not only supports better decision-making but also aids in identifying potential operational inefficiencies. The implications of QSCL extend far beyond immediate metrics, prompting considerations for long-term strategic advantages.

Understanding the Quantitative Signal Consistency Ledger

The Quantitative Signal Consistency Ledger serves as a pivotal tool for analyzing data integrity within various quantitative frameworks.

By employing rigorous signal analysis, it evaluates the consistency of quantitative metrics, providing insights into potential discrepancies.

This careful examination enables stakeholders to make informed decisions, ensuring transparency and accuracy in data reporting.

Ultimately, the ledger fosters a deeper understanding of the reliability of quantitative data.

Benefits of Implementing QSCL in Financial Tracking

How can the implementation of the Quantitative Signal Consistency Ledger (QSCL) transform financial tracking?

By enabling real-time tracking, QSCL enhances data accuracy, ensuring that financial information remains up-to-date and reliable.

This fosters informed decision-making and empowers stakeholders to respond swiftly to market changes.

Ultimately, adopting QSCL can lead to improved operational efficiency and a greater sense of financial autonomy.

Case Studies: QSCL in Action

Numerous organizations across various sectors have successfully integrated the Quantitative Signal Consistency Ledger (QSCL) into their financial operations, showcasing its transformative potential.

Real world applications highlight significant improvements in data integrity and decision-making speed.

Industry comparisons indicate a marked advantage for QSCL users, as they leverage precise analytics to enhance operational efficiency, ultimately fostering a liberated environment for informed financial strategies.

Future Implications of QSCL in Data Analysis

Building on the successful implementations observed in various organizations, the future implications of the Quantitative Signal Consistency Ledger (QSCL) in data analysis promise to reshape the landscape of financial decision-making.

Anticipated future trends highlight enhancements in data integrity and analytical advancements, enabling refined predictive analytics.

This evolution will significantly bolster decision-making enhancement and risk assessment, empowering organizations to navigate complexities with greater agility and foresight.

Conclusion

In conclusion, the Quantitative Signal Consistency Ledger emerges as a pivotal instrument in the realm of financial analytics, subtly guiding stakeholders toward enhanced data integrity. By facilitating a nuanced understanding of discrepancies, QSCL not only bolsters transparency but also fosters a more astute decision-making environment. As organizations embrace this sophisticated framework, they are likely to navigate market dynamics with greater finesse, ultimately elevating their strategic financial initiatives while maintaining an air of controlled diligence.